A report by Sikkim Express said that the State Vigilance, Sikkim Police on Wednesday registered a regular case under sections 120B (punishment of criminal conspiracy), 420 (cheating), 468 (forgery for purpose of cheating) and 471 (using as genuine a forged document) of IPC on the allegation of illegal trading activities by Sikkim-based investors on MCX platform.

It was alleged that some Limited Liability Partners (LLP) company and private individuals/traders from other States of the country have been engaged in high frequency trading on the Multi Commodity Exchange either using identity of Sikkim residents or using co location of Sikkim, illegitimately taking undue advantage of the Income Tax and Stamp Duty exemption given to the people of Sikkim, the state vigilance on Wednesday in a press statement.

The background that surrounds MCX scandal

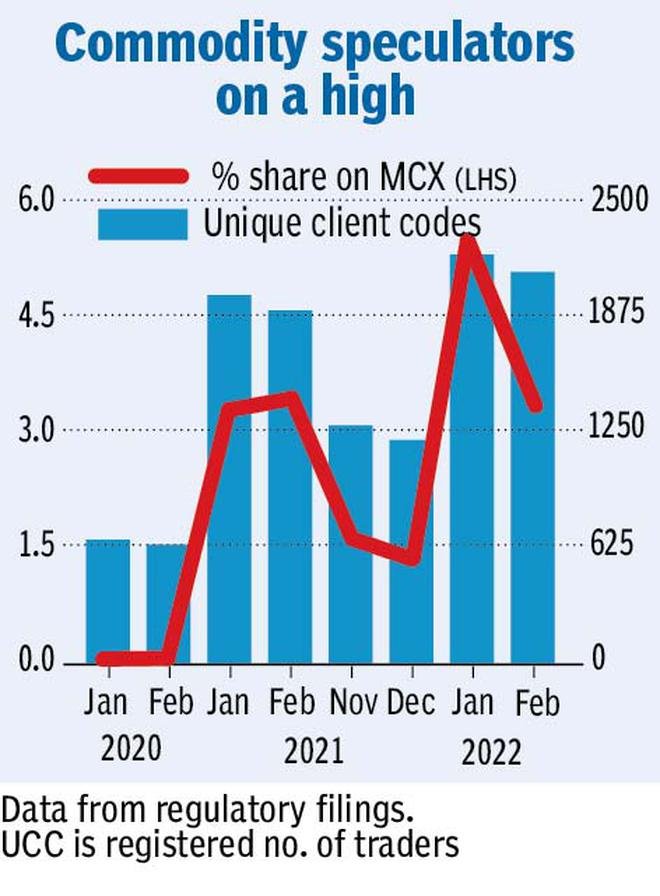

The background which surrounds the issue is that in February of this year, the market share of Sikkim-based traders on the Multi Commodity Exchange (MCX) in Mumbai climbed from zero to 5.46 per cent, and what was surprising is that this was just over a couple of years’ time-frame. Thus, taking the commodity speculators on a high tide in the market.

According to the data released, Sikkim is the only state in the whole North East Indian region that saw such an exponential growth in the MCX’s total turnover contribution. In-fact all other North Eastern states had a total turnover contribution in the MCX below 1% with Assam at 0.33% only behind Sikkim. The number of traders from Sikkim based on unique client code, has increased to 2,217 this year, as compared to 674 in February 2020.

To paint a clearer picture, in comparison to Sikkim other densely populated states see a way lesser volume in the marker, even though they have a larger number of traders. Bihar, as an example, has 2.88 lakh traders but accounts for only 1.51 per cent of the trading volumes. Similarly, Kerala has 2.04 lakh traders but its volume is just around 1.45 per cent.

Madhya Pradesh, which has 4.67 lakh traders, accounted for only 3.2 per cent, and the neighboring West Bengal with 2.05 lakh trader shared only 4.14% the total turnover contribution in the MCX in February. These numbers, in comparison to Sikkim, which has a total population of 6.79 lakh is really discombobulating for traders who have been scrutinising the mind-blowing numbers in mcx connectors, and Sikkim’s contribution in the commodity market, hence bringing more scrutiny and speculations from all around the market.

Data from the MCX shows that the market witnessed a total volume churn of over $110 billion on its platform during February, of which the state’s share stood at over $6 billion. The thing to note is, Multi Commodity Exchange of India limited is by far the largest, leading and the first listed commodity derivative exchange of the country with a total market share of 92.2% in terms of the value of commodity futures contracts traded in financial year 2021-22 and it facilitates online trading of commodity derivative transaction and functions under the regulatory framework of Securities and Exchange Board of India (SEBI).

The MCX offers trading in commodity derivative contracts across varied segments like bullion, industrial metals, energy and agricultural commodities like cardamom etc., and the data shown by such a huge and reputed corporation cannot be ignored.

It was reported that the Deputy Superintendent of Police equivalent rank officer has been tasked with the investigation on the MCX allegations.

“On getting directions from the State government, the Vigilance department swung into action and promptly collected documents and information running into several thousand pages from different offices like MCX, Registrar of Companies, banks, SEBI, other commodity exchanges, offices of the Government of Sikkim and made quick spot verifications at several places,” the statement said.

As per the Vigilance Police, several brokers and parties opened offices, some only on paper, in the State of Sikkim after July 2000 and started doing mostly online transactions in different commodities through MCX. The state vigilance said that after the probe was initiated a dip was seen in the trading volumes.

“The matter was under the radar of Sikkim Vigilance Police since the issue surfaced in March 2022. Since then, the trade on MCX saw huge dip,” said the state vigilance.