The recent scrutiny from market pundits over the staggering $6B plus trade on commodities that Sikkim faced has blown up and become a trending topic amongst the general public and political leaders alike. The numerous grey areas in Sikkim’s tax exemption that have obscured the Income Tax Act in the state have been taken advantage of and that is evident. “Is it a privilege, a loophole or is it a scam?” This is the question that surround the topic.

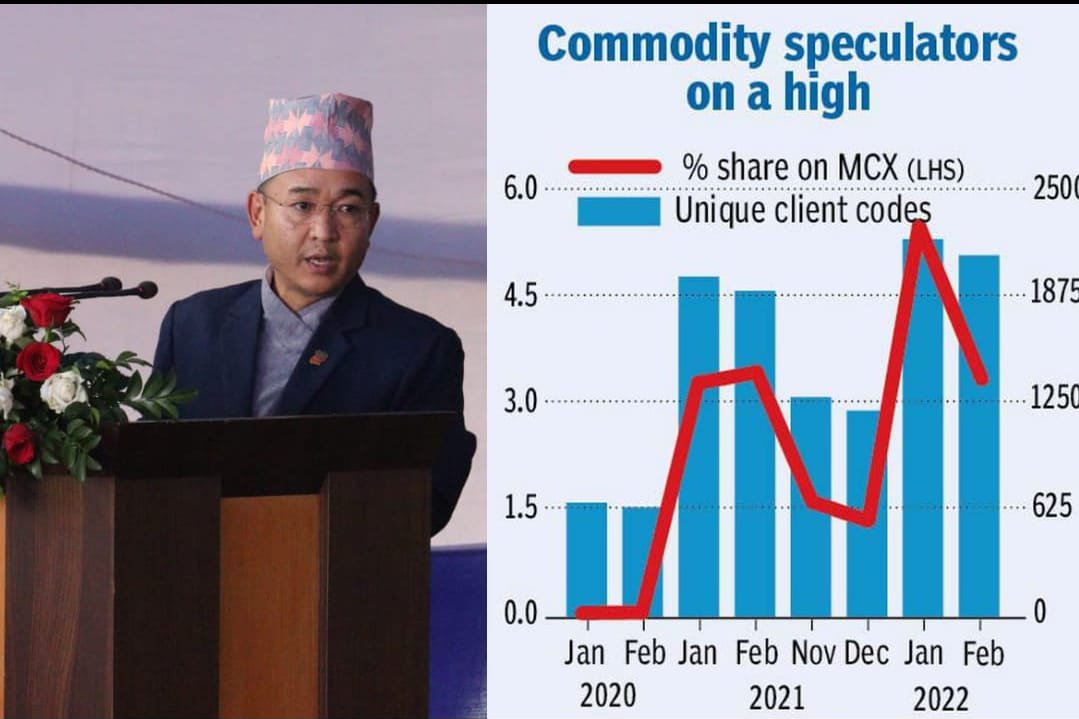

The background which surrounds the issue is that in February of this year, the market share of Sikkim-based traders on the Multi Commodity Exchange (MCX) in Mumbai climbed from zero to 5.46 per cent, and what was surprising is that this was just over a couple of years’ time-frame. Thus, taking the commodity speculators on a high tide in the market.

Data from the MCX shows that the market witnessed a total volume churn of over $110 billion on its platform during February, of which the state’s share stood at over $6 billion. The thing to note is, Multi Commodity Exchange of India limited is by far the largest, leading and the first listed commodity derivative exchange of the country with a total market share of 92.2% in terms of the value of commodity futures contracts traded in financial year 2021-22 and it facilitates online trading of commodity derivative transaction and functions under the regulatory framework of Securities and Exchange Board of India (SEBI). The MCX offers trading in commodity derivative contracts across varied segments like bullion, industrial metals, energy and agricultural commodities like cardamom etc., and the data shown by such a huge and reputed corporation cannot be ignored.

According to the data released, Sikkim is the only state in the whole North East Indian region that saw such an exponential growth in the MCX’s total turnover contribution. In-fact all other North Eastern states had a total turnover contribution in the MCX below 1% with Assam at 0.33% only behind Sikkim. The number of traders from Sikkim based on unique client code, has increased to 2,217 this year, as compared to 674 in February 2020. To paint a clearer picture, in comparison to Sikkim other densely populated states see a way lesser volume in the marker, even though they have a larger number of traders. Bihar, as an example, has 2.88 lakh traders but accounts for only 1.51 per cent of the trading volumes. Similarly, Kerala has 2.04 lakh traders but its volume is just around 1.45 per cent. Madhya Pradesh, which has 4.67 lakh traders, accounted for only 3.2 per cent, and the neighboring West Bengal with 2.05 lakh trader shared only 4.14% the total turnover contribution in the MCX in February. These numbers, in comparison to Sikkim, which has a total population of 6.79 lakh is really discombobulating for traders who have been scrutinizing the mind-blowing numbers in Sikkim’s contribution in the commodity market, hence bringing more scrutiny and speculations from all around the market.

Experts have reported that Sikkim’s newfound love for commodity speculation could be due to the exemption its residents get from the mandatory requirement of a Permanent Account Number (PAN), which allows them to skip filing tax returns. Post-2008, market regulator, Securities and Exchange Board of India, (SEBI) exempted Sikkimese residents from the mandatory PAN requirement for investments in the Indian securities market and mutual funds. The traders would only have to give a proof of residency, (Sikkim Subject or COI) to the custodians and exchanges in Mumbai. Following an order by the Sikkim High Court in 2007, SEBI issued via a circular (No: MRD/DOP/MF/Cir-08/2008) to exempt the PAN requirement for Sikkim individuals. When the Kingdom of Sikkim merged with the Indian union, a condition was laid that its old laws and a special status under Article 371(F) of the India Constitution remained intact. On such condition the tax laws of Sikkim were governed by its own Sikkim Income Tax Manual of 1948 which required none of its residents to pay taxes to the Central Government. However, in 2008 the old tax laws of Sikkim were repealed but the Union Budget that year inserted section 10 (26AAA) in the Income Tax Act of 1961, exempting the residents of Sikkim from tax. It protected the special status given to Sikkim and a word “Sikkimese” was inserted as per Article 371(F) of the Indian Constitution. Thus, according to the section 10 (26AAA) of the Income Tax Act of 1961, “in case of an individual, being a Sikkimese, any income which accrues or arises to him- (a) from any source in the State of Sikkim; or (b) by way of dividend or interest on securities:” were exempted. The exemptions from mandatory requirement of PAN and section 10 (26AAA) of the Income Tax Act, combined to result in a lack of tax filings which therefore made it almost impossible to assess market speculators from Sikkim.

Furthermore, in another serendipitous moment for the commodity traders, in September 2015, the erstwhile commodity market regulator Forwards Market Commission (FMC) which oversaw MCX, merged into SEBI. Therefore, SEBI rules of PAN exemption to Sikkim residents could have also become available to the commodity traders on MCX. What is more baffling is that more than 95% of the trading volumes on MCX is highly concentrated in the commodities like bullions, crude oil, and base metals the price discovery of which largely happens abroad. Experts scrutinize that traders from other states might be using Sikkim-based residents as a proxy to carry out these trades to avoid filing tax returns. These chain of serendipitous instances perhaps strengthen the argument of Sikkim is beginning to act almost as an “offshore financial centre” in India itself where money defaulters in the securities market could enjoy a tax haven like status of the state.

Now, in the foreground of the present moment, this has caught the attention of leaders and policy makers. Former Chief Minister and the President of the SDF party Pawan Chamling, through his party’s official statement, warned that the shocking increase in the market share on the Multi Commodity Exchange to 5.5 percent “may have an adverse impact on the tax exemption that Sikkim has been granted.” The release insinuated that this “reminded the state of the gift racket of the 1980s which had led to the extension of income tax into Sikkim by the centre.”

“The SDF government lobbied with the centre for over 13 years before securing the IT exemption in 2008. The SKM government has been recklessly and foolishly selling Sikkimese properties, assists and privileges one by one. He (Chamling) wants to know what is the SKM government doing while such illegal transactions are going on Sikkim,” SDF’s statement read.

Reminding of the 80’s infamous gift racket that led to the Income tax extension to build his case against the present government Chamling commented, “This unfortunate scam reminds us of another massive scam that had taken place in Sikkim in the 1980s under the Sikkim Sangram Parishad governance which came to be known as the Gift Racket. Crores of rupees were apparently laundered in Sikkim in the name of gifts. Local players were sending cash to non-Sikkimese “friends” as gifts. It was basically the recipients’ black money which they gave to Sikkimese players, asking them to send it back to them as gifts. They used this cleverly devised method to convert their black money into white money. The gifting partners from Sikkim were given a commission of up to 15 percent for their service.”

“India Today had reported, “As some of the biggest names in and out of Sikkim – including film stars, well-known industrialists and a local minister’s wife – figured in the deals, the issue threatened to break into a major scandal.” The report further said, “… state government officials and politicians have condoned or actively been involved in the laundering of money. Most of the businessmen on the list are supporters of the Sikkim Sangram Parishad”. The unfortunate consequence of the racket was the extension of the Income Tax Act (1961) to Sikkim,” he further added.

Chamling made comments on the ongoing tax exemption issue, “Let the Sikkimese people remember that the Sikkim Democratic Front government lobbied for 13 long years since 1994 and convinced the Centre to grant an Income Tax Exemption to the people of Sikkim. It was a huge feat for our government.”

“The income Tax Exemption for Sikkim not only has economic advantages. It also cements our pre-merger distinct Sikkimese identity in the Republic of India. Sikkim is the only state that enjoys this special status under the constitutional provision,” he added, possibly hinting to the dangers to Sikkim’s special status in the Indian constitution.

Taking jabs at the present government Chamling raised questions and alleged, “What is the SKM government doing while all these illegal, anti-national and anti-Sikkim activities are going on? Such multi-billion scams cannot take place outside the knowledge of the government. I have a serious suspicion that the Sikkim government is involved in the scam. I appeal to the Centre to initiate a fair investigation starting with the Chief Minister.”

The question raised and the allegations made are of a serious degree, to which the answers were prompt from the state government’s side as CM Prem Singh Tamang answered them at a function where he gave a speech. In that speech Chief Minister highlighted that he has directed State Vigilance to immediately start investigations on the $6 Billion commodity market trading case. The CM, in his speech stated that “there isn’t a lot to fear here” in relevance to Sikkim possibly losing its privilege of tax exemption or its special status under 371f. He said, “The market speculators don’t have to take the permission of the state government or notify it since this directly comes under the regulatory board of SEBI, and this is a matter of tax evasion.”

“Businessmen from outside are in suspicion of using the licenses and the papers of Sikkimese people, and businesses could have manipulated innocent rural citizens into submitting their COI/Sikkim Subjects to evade taxes,” the CM suggested.

He further stated, “The moment we found out about the report, we directed the State Vigilance to immediately start an enquiry into those involved so action can be taken.”

Straining on the urgency of the investigation he said, “All involved will be caught by any means.” Furthermore, he enlightened that he has spoken with the Union Finance Ministry pertaining to the case while on his visit to New Delhi. “We have requested the central government and SEBI to provide us with all the information required and we will take action against all those involved if state government needs to be involved,” CM added.

On this particular topic, former MP and SDF spokesperson PD Rai through an interview commented, “There is a certain looseness in the way that you (the SKM government) are looking at and have been monitoring this exercise.”

“Today you say that the vigilance is looking at it then I’m afraid, well, I’d rather suggest that you immediately call the CBI and just find out who are these people (the traders using Sikkimese proxies),” he said. “The innocent people of Sikkim, perhaps innocent, perhaps not, but the people of Sikkim have been trapped in this particular case by a larger financial force from outside (Sikkim), who need to be identified. This is something that we are eagerly waiting for from the government.”

He further advised, “the vigilance department doesn’t have the capability to investigate the case and I would rather go to the extent of saying that the government should actually transfer the case, if there is one, to the Union Finance Ministry in which they have a special unit to look at frauds.”

PD Rai also commented on the stand of the Chief Minister on the direction to the vigilance department for an investigation, who has notably already said that he has already spoke with the Finance Ministry. Rai said “he (CM PS Tamang) is in-charge and he has to make a beginning somewhere, but this is a case that is much bigger than the vigilance department and I don’t feel that the department has the necessary tools to enquire this case.” The departments suggested by Rai were Enforcement Directorate, the Central Bureau of Investigation, and Special Section from the Union Finance Ministry that looks into financial frauds.

The implications of this particular issue of the Commodity Market Trading can be seen to be dire and have been linked to weakening or the scraping of the tax exemptions that Sikkim enjoys, the direct ramifications of which have been feared by the common public to be a hit to Sikkim’s special status under 371f. The questions that a common man versed in this ongoing topic of a possible tax evasion or a supposed scam are:

Is this illegal or is it just a blatant use of a loophole where Sikkimese people are being used as proxies?

What kind of an investigation will pursue, if there is one?

What will be the outcome of that investigation?

Will there be a change of law centrally to prevent such blatant misuse of a privilege? Or will there be ramifications to the laws of the state?

These are the FAQs whose answers only a successful investigation and the government’s ongoing intervention would provide.